Best Drone Insurance 2026: Compare Costs, Coverage & Trusted Providers

Best drone insurance provider? The best drone insurance varies by your specific needs. Leading options include SkyWatch.AI, known for its flexible and on-demand coverage, and BWI Aviation Insurance, recognized for its extensive commercial and enterprise fleet protection. With drone technology advancing at an unprecedented pace, the number of people taking to the skies—both professionals and hobbyists—continues to rise. Drones have revolutionized modern industries, from aerial photography and mapping to agriculture, surveillance, and logistics. Yet, with greater power comes greater responsibility. Even a minor equipment malfunction, software glitch, or pilot mistake can lead to costly damages worth thousands of dollars.

Drones insurance comes in there. It was once considered an option, but now it is a significant requirement for safe and professional operation. Insurance is your financial parachute, whether you are a 3,000-dollar UAV filmmaker or a multimillion-dollar construction company that is operating a drone fleet. By 2030, it is estimated that global drone operations will be worth over $ 90 billion as a market in commercial applications, with over 70 percent driven by commercial applications. With this kind of expansion, regulators, including the Federal Aviation Administration (FAA), and clients are increasingly demanding evidence of insurance to clear the flight and qualify as a contractor.

In other words, drone insurance is no longer a luxury. It is an essential liability protection, compliance tool, and business continuity tool. This guide consolidates all the information you need, including the types of drone insurance coverage and the annual rates for 2026, secure insurance companies, and ways to lower your premiums.

What Is Drone Insurance and Why Does It Matter

Here is a quick discussion on everything you need to know about drone insurance.

Learning about Drone Insurance

Drones insurance is a specialized type of insurance designed to cover the financial losses of unmanned aerial vehicle (UAV) operators resulting from accidents, damage, or third-party claims. Similar to auto or business insurance, it covers the liability, property damage, and equipment replacement when you choose the plan.

These are of two main types:

- Recreational Drone Insurance – hobbyists who have personal drones. It has limited coverage, which is affordable.

- Commercial Drone Insurance – available to individuals or businesses that utilize drones in their operations. This involves movie producers, pollsters, farm tenants, and construction companies.

Why It’s Essential

Accidents are also possible even for experienced pilots. A drone might:

- Lose GPS connection onboard plane.

- Suffer a motor failure.

- Crash into private property.

- Injure someone on the ground.

No cover means that you will not only cover repair and replacement costs, but also face legal claims. Moreover, most clients, particularly those in the real estate, energy, and construction industries, require assurance of insurance prior to permitting aerial activities on their premises. Insurance is also mandated by the FAA and local aviation authorities to ensure that safety regulations are observed.

Example Scenario

Suppose that you have been tasked to survey a construction site using a drone. The wrath of the wind causes it to hit a crane, and your camera is ruined, as well as a section of the machinery. Liability insurance will cover the cost of repairing the crane, and your hull insurance will cover the replacement of your drone because you could have lost your drone to the tune of $15,000.

Key takeaway: The damage recovery is only one of the benefits of drone insurance; however, having your business, reputation, and finances secured so that your operations can continue uninterrupted is what it is all about. Your most valuable item in your pre-flight checklist in the data-driven, fast-paced drone economy of 2026 is insurance.

Do You Need Drone Insurance?

The brief reply: yes. If you want to fly safely, lawfully, and in confidence. Although not all flights involve the legal necessity of drone insurance, the majority of commercial flights and drones with high value must have it. The following are important considerations to make when deciding whether a policy is necessary.

1. When It’s Mandatory

FAA Requirements

Although the FAA does not currently require insurance for all operators, it does require insurance for commercial drone services that apply for waivers or operate under Part 107 credentials. Airspace use is also to be covered by some local governments and airport zones.

Client or Contractual Requirements

Uninsured drone operators will struggle to find employment in many corporations, government projects, and with event organizers. The pre-qualification checklist usually requires a list of proof of insurance.

Public Property Flights

Flight permits are typically granted through liability coverage to allow flights over crowds, social infrastructure, or populated regions.

2. When It’s Optional But Smart

Insurance provides a sense of peace even to recreational users. Consider this:

- You fly your drone into a parked car while taking sunset shots.

- An issue with the firmware can result in your drone crashing into a tree, potentially damaging the camera.

- Your drone escapes and hits a pedestrian.

You will have to pay for everything out of pocket without insurance. With broad coverage, the property of your drone and that of third parties will be safe.

3. Hobbyists vs. Professionals

Category Recommended | Coverage | DronemInsurance Cost 2026 Range | Notes |

Hobbyist | Basic liability + hull | $50-$150/year | Optional yet handy to have personal protection |

Freelancer/Small Business | Full commercial coverage | $300-$ 800/year | Often required by clients |

Enterprise/Fleet | Custom enterprise UAV plan | $1,00010,000/year | Includes multi-drone and employee coverage |

4. Event Operators and Drone Fleets

Fleet insurance is applicable in large organizations that work with multiple drones. This is a form of coverage that groups multiple UAVs together within the same policy, providing easier renewals, discounts, and claims management, all centralized.

Short-term policies or event-based policies are also popular among event operators and can last for days or weeks, making them best suited for situations that require a temporary contract.

In Summary

The drone insurance may not be a legal requirement, but when dealing with a professional setting or any other place where people, possessions, or valuable equipment are present, you will not regret spending money on it.

Types of Drone Insurance Coverage

The right drone insurance isn’t a one-size-fits-all policy. Depending on your operating needs, you’ll need a combination of coverage types. Below are the main categories every pilot or organization should understand.

1. Liability Insurance

- Purpose: Insures against injury or damage to property by a third party.

- Scenario: You have a drone crash into a car, or a person is hurt while flying.

- Coverage Range (2026): The coverage range is between $500,000 and $10 million, depending on the contract size and jurisdiction.

Why It Matters: The most vital is the liability insurance. Numerous clients and event organizers need evidence before they give permission to use their property.

2. Physical damage insurance (Hull)

- Purpose: The Purpose covers the cost of repair or replacement of your drone in case it is damaged in the air or when it is in transit.

- Scenario: Your UAV crashes into a building or drops into the storm in the water.

- Coverage Range (2026): The coverage range is typically dependent on the value of the drone replacement (1,000-50,000+).

Hint: To calculate your premium correctly, most providers demand that you provide the make and model of the drone together with the flight record.

3. Payload Coverage

- Purpose: Secures high-value attachments, including cameras, LiDAR sensors, or thermal imaging devices.

- Scenario: A LiDAR scanner mounted on the gimbal costs $10,000, which is damaged on takeoff.

- Limit: $500- 25,000, with add-ons.

- Note: Payload coverage is crucial for industries such as filmmaking, mapping, and agriculture.

4. Ground Equipment Coverage

- Purpose: You can insure accessories, such as controllers, laptops, base stations, and storage devices.

- Scenario: equipment is stolen from a car or damaged at the site.

- Coverage Range: $1,000–$10,000 typically.

5. Cyber Liability Coverage

- Purpose: Ensures the security of data from theft, hacking, or control interception in the course of drone work.

- Scenario: A hacker hijacks your drone in mid-air or steals recorded footage.

- Relevance in 2026: With the integration of AI, 5G, and real-time data cloud, cyber coverage has become more critical.

6. Personal Injury Coverage

- Purpose: Insures claims involving infringement of privacy, copyright, or other reputational damage.

- Case in point: An individual may bring a lawsuit against unauthorized aerial tape.

- Coverage Range: This depends on the state and provider, typically ranging from $50,000 to $250,000.

7. Non-Owned Drone Coverage

- Purpose: This is suitable for operators renting or leasing UAVs.

- Scenario: You have a one-day shoot with a drone that you have borrowed, and it crashes.

- Coverage: It provides coverage for liability and equipment damage to drones not owned.

Summary Table: Drone Insurance Types of Covers (2026).

|

Type of coverage |

What is covered |

Common coverage limit |

Who needs it |

|

Liability Insurance |

Liability for third-party injuries or property damage |

500K-10M |

All drone operators. |

|

Hull Insurance |

Destruction or loss of drones physically |

Up to the full drone value |

Commercial operators. |

|

Payload Coverage |

Cameras, sensors, special equipment |

500-25K |

Surveying, media, LiDAR operations |

|

Ground Equipment |

Controllers, laptops, ground stations |

$1K10K |

All commercial pilots |

|

Cyber Liability |

Hacking, lost data, unauthorized access |

Custom |

Data-driven operators |

|

Personal Injury |

Privacy/copyright infringements |

$50K-250K |

Media/real estate UAVs |

|

Non-Owned Drone |

Leased, Borrowed drones |

Custom |

Freelancers or contractors |

How expensive is Drone Insurance in 2026?

Knowing the importance of insurance for a drone is crucial before planning your budget. The market is more flexible than ever, offering the option to pay hourly on demand or sign a yearly commercial plan starting in 2026. The cost is determined by variables such as the value of your drone, the nature of your operations, and your safety history.

Average Drone Insurance Prices by Type

|

Type of coverage |

Average cost (Monthly) |

Average cost (Annual) |

Limit of the coverage |

Best for |

|

Liability Only |

$30 -50 |

$350-600 |

$1M |

General pilots and freelancers |

|

Hull + Liability |

$60–$100 |

$700–$1,200 |

$1M–$5M |

Commercial operators |

|

Fleet Insurance |

Custom Quote |

$1,000–$10,000 |

Up to $20M |

Enterprises with multiple UAVs |

|

On-Demand Insurance |

$5–$10 per flight |

N/A |

$1M |

Short-term or event operators |

|

Cyber Liability |

$25–$75 |

$300–$900 |

$500K–$5M |

Data-driven operations |

Cost Disagreements: Liability and Hull Insurance.

- Liability coverage prevents injury or damage to property by a third party. Most of them are required in commercial projects, and the monthly cost is approximately $ 30-$ 50.

- Hull insurance covers your drone itself, which is particularly necessary for high-end or custom UAVs. Hull coverage increases the cost of monthly premiums by approximately 30-50 percent, depending on the value of the drone.

As an example, a 3000 drone with both liability and hull cover might cost between $ 70-$ 90 per month, whereas a UAV with LiDAR technology may cost $ 150+ per month.

On-Demand vs. Monthly vs. Annual Drone Insurance

|

Type of plan |

Ideal to use |

Flexibility |

Coverage Period |

Ideal Providers |

|

On-Demand |

Freelancers/event operators |

High |

Hourly/daily |

AirModo, SkyWatch.AI |

|

Monthly |

Average user, regular, moderate hours |

Medium |

30 days |

Thimble, Avion |

|

Annual |

Full-time pilots, Businesses, Fleets |

Low |

12 months |

Global Aerospace, State Farm |

Tip: On-demand insurance is affordable unless you fly less than 10 hours per month. Annual plans are more economical for regular or enterprise operations.

Factors Influencing Drone Insurance Cost

The rates of drone insurance are based on a number of factors:

- Drone Value & Type: Drones with a higher value (i.e., those equipped with LiDAR, thermal, or multispectral payloads) require a premium price.

- Flight Hours and Experience: Pilots who have logged higher flight hours usually receive discounts.

- Operational Region: Flights in and around urban areas or restricted areas are more expensive.

- Coverage Amount: A $5M liability policy will cost over 500K cover, of course.

- Add-Ons: Optional cover (Any of the three) (payload, cyber, ground gear) is added to the base cost.

- Claim History: A clean flight record will reduce premiums in the long run.

Global Comparison: Drone Insurance Rates (2026)

Region | Average Liability Coverage ($1M) | Hull Add-On | Notable Providers |

USA | $500–$800/year | +$250–$600 | Global Aerospace, Avion, AirModo |

UK | £400–£700/year | +£200–£500 | Coverdrone, Moonrock |

Canada | CA$600–$1,000/year | +CA$300–$600 | SkyWatch, Phelan Insurance |

Australia | AU$550–$900/year | +AU$300–$500 | Precision Autonomy, QBE |

How to Reduce Your Drone Insurance Cost

Even though premiums are a must-have expense, you can significantly save on drone insurance costs and lower them with smart planning and operational discipline.

1. Maintain Flight Safety Logs

Regular records of safety are rewarded in the process of choosing a drone insurance provider. Maintaining a flight logbook so detailed (hours, location, maintenance data, and so on) can demonstrate your reliability and can reduce premiums by up to 15 percent.

2. Get FAA Part 107 Certification

Certified drone pilots are statistically safer. Providers often offer discounts for Part 107-licensed operators, especially in the U.S., since training demonstrates risk management competence.

3. Bundle Business Insurance

When you have a larger enterprise that includes your drone operations, then cover the UAV through your general coverage or equipment policy. Insurance companies, such as State Farm or Avion Insurance, offer multi-policy discounts of 10-20%.

4. Join UAV or Drone Associations

Organizations such as AUVSI (Association for Uncrewed Vehicle Systems International) or AMA (Academy of Model Aeronautics) frequently collaborate with insurers, offering members exclusive deals and liability insurance.

5. Use Telemetry Data

Some insurers use flight telemetry (GPS, speed, altitude logs) to rate pilot safety dynamically. Demonstrating responsible flight patterns can reduce premiums or unlock “safe pilot” incentives.

6. Review Coverage Annually

The value of your drones, as well as the frequency of flights and operational zones, varies as your business expands. By changing your policy annually, you can only pay this amount as much as you need.

Drone Insurance Policy Validity

Before signing any policy, it is essential to understand the policy’s term and the conditions for its renewal. The flexibility of coverage varies by provider, and now that you know it is as follows:

1. Policy Durations

- Monthly Policies: Perfectly suited for part-time or project-based operators.

- Annual Policies: Ideal for commercial or fleet operations with regular flight schedules.

- Event-Based Policies: Temporary cover (1-14 days) that is meant to address a film shoot, sports, or show.

2. Terms of Renewal and Cancellation

Automatic renewal is typically permitted by most insurers, but it is advisable to review it annually. The cancellation can be followed by prorated refunds, excluding administrative charges.

3. When to Update Coverage

You ought to look through your policy when:

- You recruit new drones or increase your fleet.

- You work in unfamiliar airspace or in hazardous zones.

- You upgrade payload equipment or software systems.

Having your policy up to date means you won’t be denied a claim.

The 2026 Best Drone Insurance Providers

Selecting the appropriate insurer will or will not affect your claim experience. The list of the highest-rated drone insurance companies in 2026, along with their areas of coverage and target audience, is provided below.

Top Drone Insurance Companies Comparison (2026)

|

Provider |

Type of coverage |

Limit |

Best For |

Average Cost |

Highlights |

|

AirModo |

On-demand |

$1M |

Freelancers, event pilots |

$30/mo |

Instant mobile policy, pay-per-flight. |

|

Avion Insurance |

Full coverage |

$2M |

Commercial pilots |

Custom quote |

FAA-compliant, multi-UAV coverage. |

|

Global Aerospace |

Corporate |

5M+ |

Enterprise |

Quote only |

Comprehensive enterprise liability. |

|

State Farm |

Personal |

1M |

Hobbyists |

60/year |

Buried with homeowner’s insurance. |

|

DJI Care |

Equipment alone |

Variable |

DJI owners |

$129/year |

OEM repair/replacement coverage. |

|

Thimble |

Flexible term |

1M |

Small business pilots |

$35-50/mo |

Fast set up, short-term flexibility. |

|

Coverdrone (UK) |

Full coverage |

£1M |

UK business users |

£400/year |

Excellent EU liability coverage |

Provider Highlights

- AirModo: Ideal when you are a freelancer and require temporary, mobile-friendly coverage. Activation in just a few minutes.

- Avion Insurance: Best suited to those commercial operators with tailored fleet plans. Drone insurance, FAA requirements, and approved policies.

- Global aerospace: Optimal enterprise-level coverage with the largest liability limits and customized global coverage.

- State Farm: The best choice when the customer is a hobbyist and only needs basic drone protection.

- DJI Care: Ideal for those who require the manufacturer’s direct repair coverage.

- Thimble: Flexible policies to cover small businesses or creative freelancers.

- Coverdrone: UK and EU trusted in the protection of broad liability and equipment.

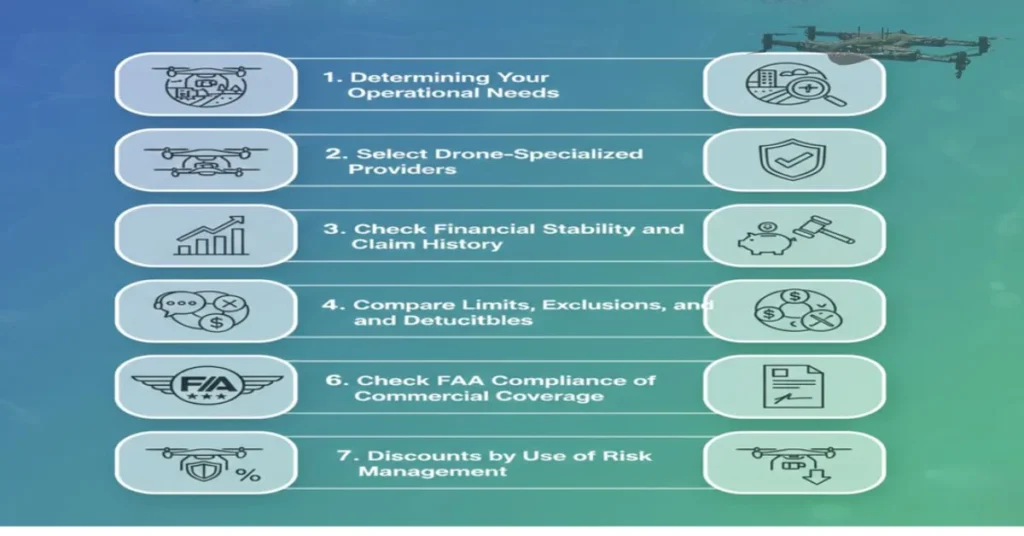

Where to Select the Best Drone Insurance Company

When choosing the appropriate drone insurance company, it is not just a matter of price-checking, but rather a question of finding a company that can provide adequate coverage in accordance with your level of operational risk and your area of compliance and expansion.

The relevance of customized coverage has never been higher in 2026, as the UAV ecosystem is poised to expand into the logistics, surveying, and creative sectors. This is a comprehensive tutorial on making an informed choice.

1. Determining Your Operational Needs

Begin by outlining your expectations for the use of your drone:

- Recreational flyers may only require liability protection or repairs under DJI Care.

- Commercial operators, such as real estate videographers or surveyors, need a wider hull and payload coverage.

- Enterprise fleets may require high-limit policies with worldwide liability caps.

Tip: You should always list your types of mission (filming, mapping, inspection, etc.) first before you seek quotes. It makes sure that your provider provides the appropriate risk classifications.

2. Select Drone-Specialized Providers

UAV operations are not well comprehended by all insurers. UAV policy providers, such as Avion Insurance, Global Aerospace, and AirModo, have underwriting and claims teams that are conversant with FAA regulations, various drone models, and actual flight risks.

An insurer of drones may usually cover:

- On-the-fly flight risk assessment systems.

- In-house compliance testing (FAA Part 107 documentation)

- Add-ons to payloads, sensors, and telemetry data.

3. Check Financial Stability and Claim History

You should always investigate an insurer’s financial status and its reliability in claims. Look for:

- A.M. Best or Moody rating: A or better.

- Check claim satisfaction reviews: Do not use insurers who have long claim delays or where claim denials are high.

- Turnaround time: Fast service during flight incidents can make a significant difference between a straightforward claim and a financial loss.

4. Compare Limits, Exclusions, and Deductibles

Costly exclusions can be disguised by a low premium. Carefully check:

- Deductibles: There are policies where one is under 500 or 1000 before they are refunded.

- Coverage limits: The coverage limit must be appropriate to your project.

- Geographical limits: Check coverage on your operation areas (local or foreign).

A sample policy document should always be requested prior to finalization.

5. Measure Customer Support and Claim Response

Insurance providers such as DoneDeal and DroneShield have specialized teams for drone insurance. Look for:

- 24/7 claims hotline or portals.

- Simple generation of a certificate of insurance (COI) for clients.

- Timely turnaround times on claims.

The impact of untidy communication on a provider may lead to the loss of a client or the postponement of a project approval.

6. Check FAA Compliance of Commercial Coverage

The FAA does not currently require insurance for drones, but it does request that operators demonstrate financial responsibility in specific operations. Ensure your policy:

- Complies with FAA Part 107 standards of operation.

- Includes commercial and BVLOS (Beyond Visual Line of Sight) operations (where applicable).

- Known to the authorities in the major aviation bodies in terms of contracts or permits.

7. Discounts by Use of Risk Management

Implement preventive safety measures to reduce premiums:

- Conduct pre-flight risk assessment.

- Maintain maintenance logs

- Apply GPS and telemetry surveillance.

- Become members of professional UAV organizations (AUVSI, AMA, DroneUp).

You can be offered loyalty or safety discounts of up to 20 percent by the insurers in the long run.

Drone Insurance fables and fallacies.

Many pilots do not purchase insurance because they are misinformed. In 2026, the most popular drone insurance myths should be disproved.

Myth #1: Homeowners' insurance includes drones.

Fact: Drone crashes, property damage, or commercial use are mostly not covered by standard homeowner policies. They can only guard against home robbery.

Myth 2: Recreational pilots do not need insurance.

Fact: Hobbyists can also be dangerous or harmful, even to hobbyists. Coverage: You can get liability coverage as low as $30/month, which would cover you on thousands of possible claims.

Myth #3: Payload is included at all times.

Fact: Payloads (such as cameras and LiDAR sensors) frequently require individual coverage. Do not expect your hull cover to cover them; you should always check with your provider.

Myth #4: Drone insurance is too costly.

Facts: There are numerous policies that begin at less than $40/month with full liability coverage, and event insurance is sometimes cheaper than the rental charges for one night. Uninsured operating is the actual cost.

Drone Insurance and FAA Compliance

Although the FAA does not currently mandate insurance for all operators, professional licensing and accountability are closely associated with it. The presence of coverage increases credibility, and in the near future, it is likely to become a prerequisite for all commercial UAV pilots.

FAA Part 107 and Insurance Links

Under Part 107, the pilots will be liable for any injury or damage caused by their drone. The financial support to fulfill this legal requirement is made through insurance.

The typical FAA-related businesses that require insurance:

- Filming around people’s property.

- Commercial mapping or inspections

- Under waiver, BVLOS or night operations.

Evidence of Commercial Operation Coverage

More clients and local authorities demand:

- A Certificate of Insurance (COI) indicating that it is liable to a certain amount (typically $1M)

- Signed as an additional insured of event contracts.

- Policy number and expiration date

Insurance also falls under the category of a responsible operator profile, as identified by FAA inspections and audits.

FAA-Approved and Recognized Providers

Although the FAA does not directly certify the insurers, they note the ones that might qualify as being of aviation grade, including:

- Global Aerospace

- Avion Insurance

- SkyWatch.AI

- AirModo

- Thimble

These companies are in compliance with FAA Part 107 and aviation liability frameworks.

Conclusion: Lock Your Drone and Your Future.

The innovation of drone technology has transformed industries, including construction and filmmaking, but there should be a corresponding responsibility. The drone insurance of 2026 is no longer a luxury that professionals add to their work; it is an investment in the security and reliability of their career. The right drone protection plan will ensure that you can get back on your feet quickly in the event of a crash, theft, or liability case, without compromising your business continuity.

As an individual photographer or a UAV fleet leader, a consistent partner such as Avion Insurance, Global Aerospace, or AirModo will ensure coverage that is compliant with FAA regulations and up-to-date with the latest standard guidelines. The next time you fly, be sure to take a few minutes to shop around, see what providers offer, check your coverage cap, and secure your drone, as well as your future.

Fly smarter. Fly insured.

Compare the most suitable drone insurance policies available and protect your aerial investment.

Drone Insurance FAQs (2026)

Does the FAA require drone insurance in 2026?

No, however, it is highly advisable for all business operations, particularly those involving FAA waivers or those that operate on the public ground.

Theft or flyaway is insured?

Yes, in case you include hull coverage or special theft and loss riders. Always confirm terms.

Is it possible to get insured in case of an accident?

No. Policies should be operational before the incident occurs. The cover after the accident is invalid.

What influences my premium?

Drone worth, pilot expertise, area, customer frequency of flight, and history of prior claims.

Where can I purchase drone insurance?

Directly with companies such as AirModo, Avion Insurance, Global Aerospace, Thimble, or State Farm.

Which is the most affordable drone business coverage?

AirModo or SkyWatch on-demand liability insurers will have a starting price of $ 10 per flight.

Is it possible to combine the insurance of drones with my company's policy?

Yes. Most small businesses will incorporate UAV insurance as part of their general liability coverage to receive better rates.

Does it have event or short-term coverage on drones?

Yes, those event policies are allowed to cover single-day event operations, such as sports filming or real estate shoots.

Contact Us

Thank you for your message. It has been sent.